You make thousands of decisions every year. Most are forgettable. A few are existential. What makes these decisions existential is not just their impact, but the fact that organizations routinely fail to commit to them with enough clarity and structure to survive execution.

The existential ones — product portfolio shaping, annual budget allocation, marketing investment mix, capacity planning, R&D prioritization, territory redesign — share a common profile:

- They recur on a predictable cycle (quarterly, annually, or every 18–24 months)

- A 5–10% swing changes operating margin by millions or tens of millions

- They cut across functions and incentives

- They are too complex for any single person to reason through fully

- They cannot be fully automated — human judgment is essential

- Yet they are too important to be left to unstructured judgment

These are strategic decisions. And almost every company treats them with tools and processes like tactical ones, guaranteeing drift, renegotiation, and a decaying business case.

What We Mean by “Strategic Decisions”

Strategic decisions are high-impact, recurring choices that commit material resources under uncertainty and shape outcomes over multi-year horizons.

They sit in an uncomfortable middle ground:

- Too judgment-laden for pure automation

- Too consequential for intuition, spreadsheets, or one-off analysis

- They require human intent — priorities, risk tolerance, trade-offs — but they benefit dramatically when that intent is applied to structured, optimized options instead of raw intuition.

That tension is the root of the problem: organizations need judgment, but lack the structure to apply it consistently and commit to it over time.

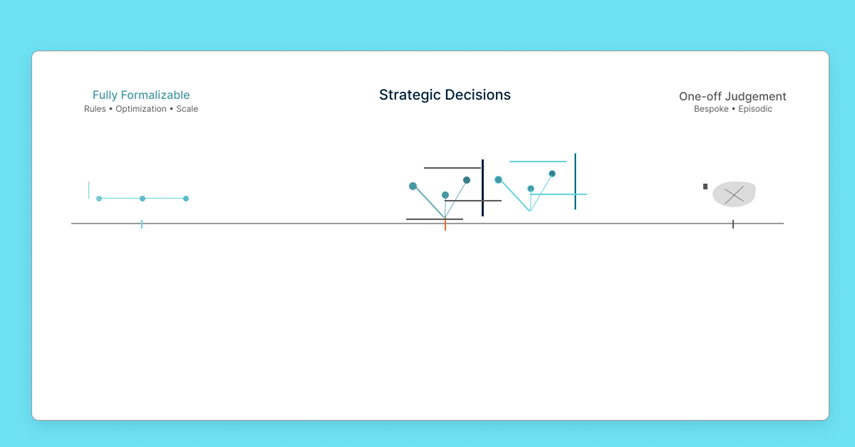

Where Strategic Decisions Sit on the Decision Spectrum

While there are many types of strategic decisions, they are best understood by how formally they can be structured, not by how big or small they are.

1) Fully Formalizable Decisions

These decisions can be expressed with a small, stable set of criteria and constraints and solved reliably with optimization or rules.

They may be:

- High volume / low value (e.g., inventory replenishment), or

- Low volume / very high value (e.g., daily energy dispatch, airline yield management)

What matters is not scale — it’s that:

- objectives are unambiguous

- trade-offs are well understood

- uncertainty is bounded

Once encoded, these decisions can run with minimal human intervention.

2) Analytically Informed One-Off Decisions

These decisions benefit from deep analysis but are not repeatable in the same form.

Examples:

- Should we acquire Company X?

- Should we enter Market Y?

- Should we shut down Plant Z?

They involve:

- custom models

- bespoke assumptions

- a unique fact pattern

Analysis informs the choice, but there is no enduring decision structure to reuse. Each instance stands alone.

This is where consultants and bankers thrive — and where Decision Intelligence is usually not the right tool.

3) Structurally Complex, Judgment-Driven Decisions (Strategic Decisions)

These decisions recur, but cannot be reduced to a small, stable objective function.

They are characterized by:

- Multiple, competing objectives

- Dynamic constraints across silos

- Material uncertainty over long horizons

- Human intent that must be expressed explicitly

Optimization alone fails. Intuition alone fails. Without structure, organizations oscillate between the two—formalizing what’s easy and improvising what matters most.

These are the decisions that require an augmented version of Decision Intelligence — systems that let human judgment define priorities and constraints, and mathematics explore the feasible trade space.

Why Strategic Decisions Are Uniquely Hard

Strategic decisions are unique—they repeat, involve complex and subjective factors, and errors have compounding costs. Organizations often treat them as either formal problems (leading to oversimplification) or as isolated analyses (resulting in no learning or scale), but both approaches miss the mark.

The real failure mode isn’t just bad analysis or weak execution, it’s the absence of a structure that connects insight, decision, and action. Without that structure, disconnected analysis creates circular discussion, decisions remain ambiguous, and execution quietly diverges.

These decisions are difficult not due to their size, but because they require structure without complete formalization. That distinction is crucial.

When strategic decisions are handled with tactical tools, you see the same pathologies everywhere:

- Three-month planning cycles that deliver February’s plan in June

- 400-tab Excel models only two people understand (and one is already leaving)

- Final meetings that feel more like negotiations than decisions

- Outcomes that look suspiciously like last year’s plan plus 10%

- “Strategic initiatives” that quietly die once execution begins

Despite massive investment in ERP, BI, and now GenAI copilots, the 20–50 decisions that actually move enterprise value are still run on PowerPoint and hope.

Why Strategic Decisions Break Traditional Planning Tools

Strategic decisions fail when organizations lack predictive insight, a clear mechanism for turning that insight into a decision, or a reliable way to carry that decision into execution. Most failures involve more than one of these at once.

Strategic decisions aren’t harder because leaders are worse at them. They’re harder because they fail along predictable fault lines.

1) Constraint Explosion

Tactical decisions have one or two hard constraints. Strategic decisions have dozens — financial, operational, regulatory, competitive, cultural — spread across systems and org charts.

Without a shared structure, constraints get negotiated away instead of enforced.

2) Intent Gets Lost in Translation

Strategy is expressed narratively (“grow efficiently,” “protect the core,” “invest for the long term”). Execution systems optimize what’s measurable, not what’s intended.

Spreadsheets can calculate outcomes. They cannot encode intent.

3) Scenario Blindness

The value isn’t in enumerating endless what-ifs. It’s in comparing strategic intents, for example, short-term revenue vs. long-term loyalty, or, margin expansion vs. innovation optionality

Good scenario modelling is very hard with traditional tools, because so many parts of the analysis must made variable.

4) Long Horizons, Noisy Feedback

Strategic decisions look 12–60 months out. Forecasts give false precision. Feedback arrives years later, if at all. There is no institutional learning loop.

5) Political Gravity

As stakes rise, advocates multiply. In the absence of a decision structure, hierarchy and volume replace logic. Meetings become bargaining sessions. Outcomes reflect power, not clarity.

The result: organizations accept mediocrity in the exact place they can least afford it.

This Is the Gap Decision Intelligence Exists to Fill

This is not a data problem. It’s not an AI problem. And it’s certainly not a spreadsheet problem.

Decision Intelligence (DI) is the discipline of designing systems that either automate decisions, or combine human judgment with models, optimization, and rules to make complex decisions repeatable, explainable, and improvable over time.

“For strategic decisions, DI does not replace leaders. It replaces unstructured decision-making with systems that connect insight, judgment, and execution

At the core is a decision architecture — a formal structure that makes the implicit explicit:

- Criteria: what matters, and how much

- Constraints: what is non-negotiable

- Assumptions: what you believe about the future

Predictive models estimate outcomes. Optimizers surface viable options within those bounds. Human judgment selects from informed alternatives instead of inventing them from scratch.

What Strategic Decision Intelligence Looks Like in Practice

When organizations modernize strategic decisions, the shift is structural, not cosmetic.

Explicit rules replace hidden agendas

Objectives are defined and weighted upfront. Debate moves from “what are we optimizing?” to “which trade-off do we choose?”

Scenarios become tools for discovery

Instead of endless what-ifs, leaders test sensitivities: assumptions, priorities, constraints. The system reveals where judgment actually matters.

Models tame complexity

Optimization doesn’t decide. It narrows the field to options worth debating.

Feedback closes the loop

Outcomes feed back into the architecture. Assumptions improve. Drift declines. Institutional memory forms.

Integration prevents strategy evaporation

Decisions push directly into execution systems. Strategy survives contact with reality.

The result

Across organizations that systematize strategic decisions, the same patterns show up:

- Planning cycles shrink dramatically once trade-offs are explicit

- ROI improves modestly but reliably as intent replaces negotiation

- Portfolio regret declines when constraints stop being bargained away

Strategic Decisions Are Different

Strategic decisions are different because the cost of being average is enormous — and because the tools to be excellent have only recently arrived.

Most companies will keep treating them as episodic ceremonies powered by heroics and legacy spreadsheets.

The ones that win the next decade will treat strategic decisions as repeatable systems — governed by decision intelligence, refined every cycle, and resilient to politics, complexity, and time.

If your most important decisions still feel like events instead of processes, you’re not behind.

You’re just using 1980s technology for 2025 problems.